EA+ prides itself on delivering valuable benefits that make a difference in members lives and boasts a long history of prioritizing the needs of members. EA+ does all of this while saving members tens of thousands of dollars when a medical emergency occurs during travel.

Average cost of an air ambulance within the U.S.

Travelers protected by Emergency Assistance Plus

World Travel Protection

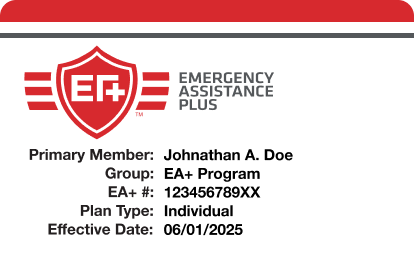

Emergency Assistance Plus® (EA+®) is an annual membership that provides cardholders with protection anytime they travel. Whether they’re thousands of miles away or merely a short road trip from home, EA+ members take with them the peace of mind knowing that should a medical emergency arise, there’s a team of highly skilled professionals at the ready to ensure they are receiving proper medical care and are provided necessary transportation home.

You've got questions? We've got answers. Our Member Care Team is standing by, ready to help.

Available Monday – Friday between 8 AM and 7 PM Eastern Time

Sharon and Joe B., Florida

“All of you at Emergency Assistance Plus were there not only for Joe, but for me. I wanted to go home and felt I would be lost in Spain forever. They listened to me cry and comforted me by telling me I was not alone, and help was on the way, and I would not be left. I had a very emotional time with all of this. I can’t tell you enough how comforting all of you were to me.”

For questions about membership, or to renew over the phone, give us a call Monday – Friday between 8 AM and 7 PM Eastern.

CUSTOMER SERVICE & BILLING

If you'd prefer to manage your account online, you can access My Account to review your membership details, make a payment and download membership materials.